50+ how much should my mortgage be based on my salary

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. And try to keep your total.

How Much Mortgage Can I Afford Smartasset Com

Web Your housing payment shouldnt be more than 2170 to 2520.

. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Use NerdWallet Reviews To Research Lenders. Down Payment Amount - 25000 10.

Lock Your Rate Today. Web My broad guideline is to keep your monthly mortgage payment including insurance and property taxes at 28 of your pretax income. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment.

Back-end DTI adds your existing debts to your proposed mortgage payment. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Once you input your monthly obligations and income the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment and total mortgage amount. For example lets say your pre-tax monthly income is 5000.

Leverage Our Resources To Grow Your Business. Attn Home Builders and Real Estate Brokers. Web The table below shows example calculations for maximum borrowing based on salaries between 30000 and 34000 per year.

Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Ad CMG Financial Is An Experienced And Successful Mortgage Joint Venture Partner. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

Your maximum monthly mortgage. Estimate your monthly mortgage payment. The amount of a mortgage you can afford based on your salary often comes down to a rule of.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web A 15-year term.

Take Advantage And Lock In A Great Rate. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Comparisons Trusted by 55000000.

Web To calculate how much house you can afford weve made the assumption that with at least a 20 down payment you might be best served with a conventional loan. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web How Much of a Mortgage Can I Afford Based on My Salary.

Web If your down payment is 25001 or more you can find your maximum purchase price using this formula. Web You can find this by multiplying your income by 28 then dividing that by 100. Principal interest taxes and insurance.

Ad 10 Best House Loan Lenders Compared Reviewed. How Much Interest Can You Save By Increasing Your Mortgage Payment. Web Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

Ad Get Preapproved Compare Loans Calculate Payments - All Online.

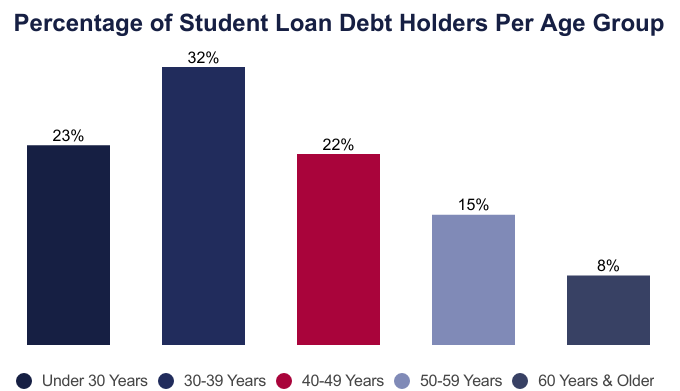

Average Student Loan Debt By Age 2023 Facts Statistics

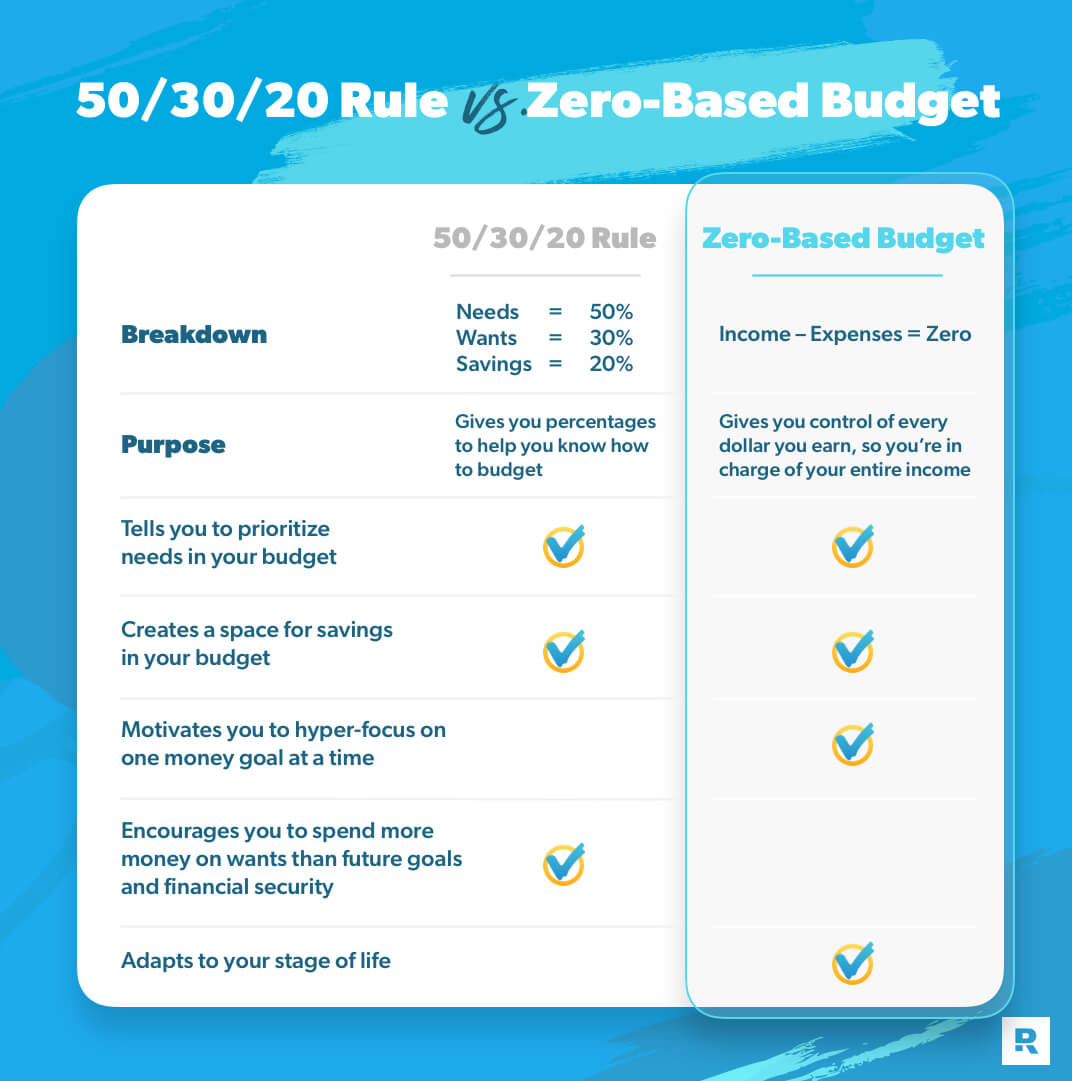

The 50 30 20 Rule Ramsey

What Approximately Was The Average Price Of A House In Paris France 50 Years Ago Quora

College Degree After 50 Is It Worth It It Depends Updated Career Pivot

:max_bytes(150000):strip_icc()/one-income-two-people-2000-6da83e67f96a4e5583697998af94f9eb.jpg)

How And Why To Live On One Income In A Two Income Household

No 10 Considers 50 Year Mortgages That Could Pass Down Generations Mortgages The Guardian

How Much Mortgage Can You Really Afford Quora

The Most Common Multiple Income Streams

How Many People Out Of 100 Make Over 50 An Hour Quora

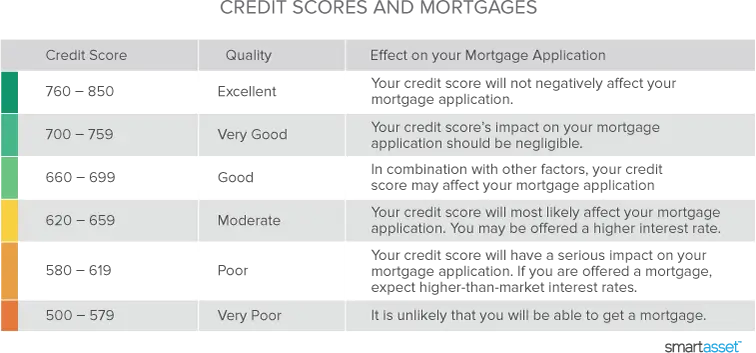

Credit Scoring Startups Breaking The Exclusion Cycle Dealroom Co

50 Loan Pick Up Lines New

Example Uk Charity Fundraising Budget Template

High Percentages Of Homeowners And Renters Age 50 Pay 30 Or More Of Download Scientific Diagram

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

7 Steps To Start Saving For Retirement After 50

The Complete Guide To Property Finance By Richard W J Brown Ebook Scribd

5 Ways Starting Fire At 50 Differs From Starting At 30 Or 20 50plusonfire